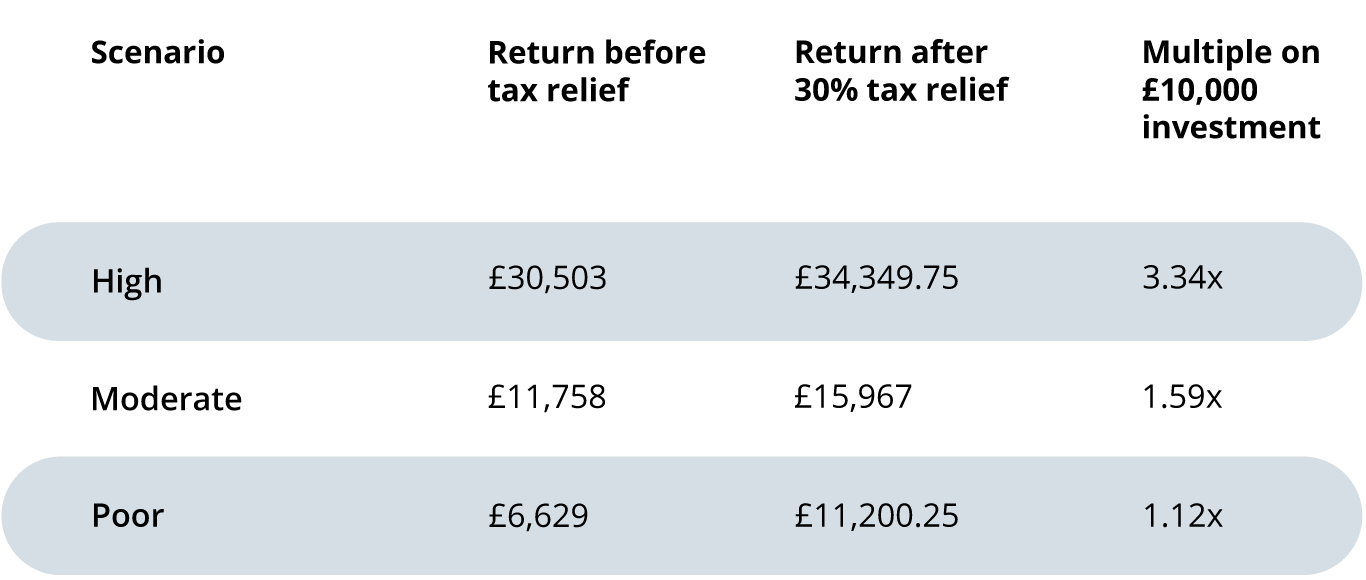

While tax reliefs may significantly reduce the risk of your investment, the Angel Academe EIS Fund I is primarily targeting companies with strong growth potential. Let's examine what a £10,000 investment could potentially return across different scenarios.

Investing in early-stage companies led by female founders represents both a significant market opportunity and a chance to address a persistent funding gap. The Angel Academe EIS Fund I, the UK's first EIS fund dedicated to female founders, offers investors a way to access this untapped potential while potentially benefiting from substantial tax advantages. Here's what investing in this groundbreaking fund could mean for you.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

With a minimum investment of £10,000, the Angel Academe EIS Fund I provides:

Immediate diversification across 7-10 high-growth potential tech companies led by female founders.

Access to expert selection from the UK's leading female-focused angel network with over a decade of experience.

Carefully curated opportunities from more than 500 companies screened annually.

Potential for significant returns - the fund is targeting a 3x return (gross of tax reliefs and net of fees) after 10 years.

Generous EIS tax benefits that significantly reduce your investment risk. Tax reliefs are subject to status and change.

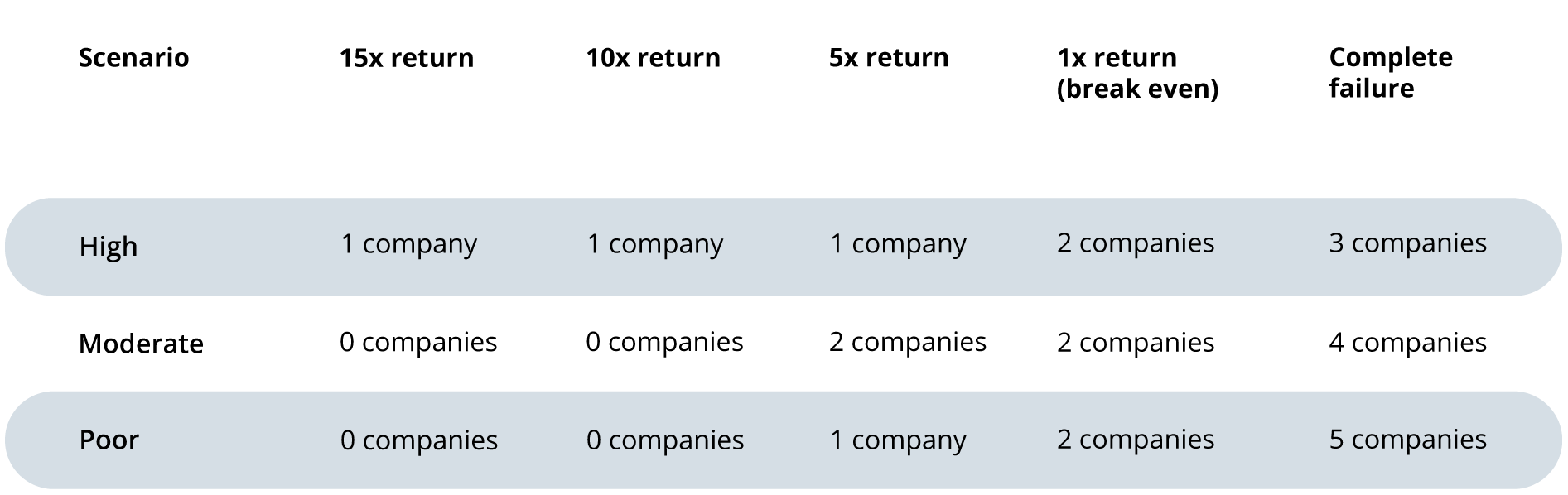

The fund will invest in a portfolio of approximately 8 companies. Below are three illustrative scenarios showing different potential outcomes for these investments:

As the tables demonstrate, even in a poor performance scenario where most companies fail, the EIS tax relief helps to protect your initial investment. In the high performance scenario, which aligns with Angel Academe's track record of successful investments like Uncommon (30.7x) and Béa Fertility (8.4x), the potential returns are substantial.

It's important to remember that these scenarios are illustrative. Early-stage investing is inherently high-risk, and past performance is not a reliable indicator of future results. Additionally, all gains would be free from capital gains tax, further enhancing your effective return.

The fund's strategy of investing in female-founded businesses across different technology sectors aims to balance risk while targeting significant returns. Angel Academe's portfolio demonstrates the potential in this underserved market segment.

Unlocking the potential of female founders: What the Angel Academe EIS Fund I could mean for you.

Please note, the above performance table uses the assumptions outline below for company performance within the portfolio.

Despite compelling evidence that female-led businesses often outperform, they remain dramatically underfunded. According to Beauhurst, in the first half of 2024, all-female founded businesses secured just 1.8% of equity capital while all-male teams received 86%.

Research from Boston Consulting Group and the Kauffman Foundation has shown that women-run businesses are often more capital efficient and can deliver higher returns on investment than male-founded startups. Angel Academe's portfolio demonstrates this potential:

Uncommon (previously Higher Steaks): 30.7x multiple on invested capital.

Béa Fertility: 8.4x multiple on invested capital.

Provenance: 5.7x multiple on invested capital.

CENTURY Tech: 5.5x multiple on invested capital.

The Enterprise Investment Scheme (EIS) offers some of the UK's most generous tax incentives. When you invest £10,000 in the Angel Academe EIS Fund I, you may be eligible for:

30% income tax relief – Up to £3,000 can be claimed back against your tax bill.

Capital gains tax deferral – Any gain made through the sale of assets can be reinvested in EIS and deferred for as long as the investment is held.

Tax-free capital gains – Any profits from selling EIS shares after three years are completely tax-free.

100% inheritance tax relief – EIS investments typically qualify for 100% relief after two years.

Loss relief – Any losses can be offset against income tax or capital gains tax, further reducing your risk.

Tax reliefs are subject to status and change.

These benefits significantly improve the risk-return profile of your investment, making EIS one of the most tax-efficient ways to support high-growth businesses.

Angel Academe has been investing in female founders since 2014, building a strong track record:

Backed over 53 startups across more than 100 funding rounds.

Helped portfolio companies raise in excess of £200 million.

Award-winning team recognized as "Best Angel Team 2024" at the UK Growth Investor Awards.

The fund combines Angel Academe's expertise in identifying promising female-founded businesses with SyndicateRoom's experience as an FCA-regulated fund manager that has facilitated more than £260m in investments across over 200 portfolio companies.

The persistent funding gap for female founders represents a market inefficiency and a significant opportunity for investors. By addressing this gap, the Angel Academe EIS Fund I offers a chance to:

Access untapped potential in an underserved segment of the market

Diversify your portfolio with companies that may have different approaches to problem-solving and market opportunities

Support diversity in the entrepreneurial ecosystem while seeking financial returns

Benefit from tax advantages that significantly reduce investment risk

Target raise: £1.2 million

Target portfolio: 7-10 companies (preferred number is 8)

Investment timeframe: Full deployment targeted by the end of the 2025/26 tax year

Exit timeline: Returns expected within 7-10 years, though minimum holding period for EIS qualification is 3 years

Setup fee: 2% + VAT

Annual management fee: 2% + VAT (years 1-7), 0.75% + VAT (years 8-10)

Performance fee: 20% with no hurdle on a deal-by-deal basis

.png)

"Raising early-stage investment as a femtech founder isn't easy, but Angel Academe immediately understood the scale of the problem we're solving and the opportunity behind it. They've backed Béa with conviction, not just once, but across multiple rounds, becoming one of our largest investors." - Tess Cosad, Co-founder & CEO of Béa Fertility

"Sarah and the Angel Academe team and network have been a huge support to me on my Founder journey. It's a fantastic network of smart, straight forward, value-add angels and very well regarded and plugged into the UK startup scene." - Jessi Baker, Founder of Provenance

Applications are open from 20 May 2025 until 31 October 2025. Click the button below to visit the fund page if you would like to make an investment

Please note: our office hours are weekdays, 9.30am - 5.30pm.